On January 10, 2024, the Securities and Exchange Commission (“SEC”) granted approval to spot bitcoin exchange-traded products, a little over 10 years after the first application with the SEC to create a spot bitcoin product. Within the first three days of trading, bitcoin exchange-traded funds (ETFs) pulled in just under $900 million from investors.

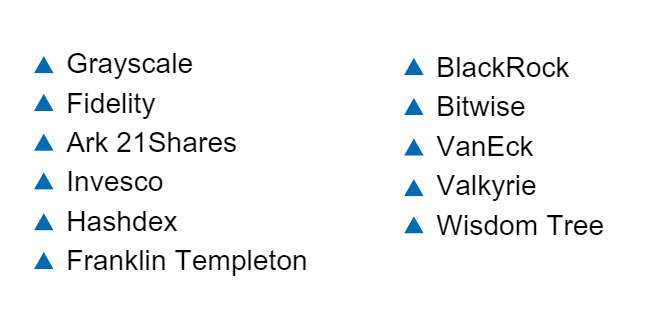

Grayscale, which has run a bitcoin trust since 2013, helped to open the door to regulatory approval for the bitcoin ETFs after winning a court victory against the SEC last year. Grayscale’s bitcoin trust was converted to an ETF structure at the same time that 10 new ETFs were approved. Below is a list of the sponsors of the new spot bitcoin ETFs:

Key Considerations

While it may be tempting to jump on the bandwagon to invest in a spot bitcoin ETF, there are several matters that investment advisers of registered mutual funds (or exchange-traded funds) should consider before adding this asset class to a fund’s investment strategy. Please review these considerations and reach out to your fund counsel and/or your fund CCO to determine a reasonable approach to this new opportunity.

Investment Objective and Investment Strategy

The adviser should review the fund’s investment objective and investment strategy as presented in the fund’s registration statement. An adviser should consider whether an investment in a spot bitcoin ETF is consistent with the fund’s investment objective. The volatility profile of bitcoin may not be appropriate for all funds.

Board Approval

Whenever a fund’s investment strategy is revised, the fund’s board of trustees must approve the proposed change, usually requiring the fund’s adviser to present to the board the details of the strategy change, reason for such change, expected benefits of the change, and expected challenges to implementing the change (operational, compliance, performance volatility).

Currently, a number of boards have prohibited or limited the use of investments either directly or indirectly related to cryptocurrency. With the advent of these new spot bitcoin ETFs, it is possible, but not guaranteed, that those boards will re-evaluate their position. An adviser may want to inquire with its fund counsel to determine the likelihood of the fund board approving an investment strategy change that includes the use of spot bitcoin ETFs.

Registration Statement Disclosure

Permissible asset classes included within a fund’s primary investment strategy are disclosed in a fund’s prospectus/summary prospectus, accompanied by risk disclosures corresponding to such asset classes. In addition, the description of lesser used asset classes or strategies (usually limited to 5%-10% of a fund’s net assets) are typically included in a fund’s statement of additional information. Because these spot bitcoin ETFs are newly registered with the SEC, it is likely that your fund’s registration statement does not currently contain language describing this new asset class. Depending upon the expected level of use of spot bitcoin ETFs in a fund’s investment strategy, for a fund to invest in them, fund counsel needs to determine if it is necessary to prepare and file a “485a” registration statement update which contains the required discussion of the spot bitcoin ETF, its anticipated use within the fund’s investment strategy, and relevant risk disclosures. The SEC has 60 days after the filing of this type of registration statement update to review and approve such language.

Tax Implications

In each taxable year, a fund must derive at least 90% of its gross income from:

(a) dividends, interest, payments with respect to certain securities loans, and gains from the sales or other disposition of stock, securities or foreign currencies, or other income (including but not limited to gain from options, futures and forward contracts) derived with respect to its business of investing in such stock, securities or foreign currencies; and

(b) net income derived from interests in certain publicly traded partnerships that are treated as partnerships for U.S. federal income tax purposes and that derive less than 90% of their gross income from the items described in (a) above (each a “Qualified Publicly Traded Partnership”). This is called the “90% Gross Income Test”.

ETPs versus ETFs

Unlike bitcoin futures ETFs, which are 1940-Act registered funds, spot bitcoin ETPs (exchange-traded products) are registered in accordance with the Securities Exchange Act of 1933 and as such, are established as grantor trusts. As a grantor trust, the fund’s investment in it will deem the fund as holding a proportionate amount of the underlying asset which are bitcoins. And, since bitcoins are considered property and not currency, any gross income or capital gains (excludes capital losses) generated by holding the ETPs will be considered “non-qualifying income” to the fund. Financial statements of grantor trusts are not distributed to investors until after the calendar year end, therefore, a fund may not be aware of how much non-qualifying income is allocated from the grantor trust to the fund. This is a concern as funds can find themselves failing the 90% gross income test without realizing it.

IRS Diversification Tests

Additionally, funds are subject to IRS Asset Diversification requirements. Generally, the test can be broken into two percentage tests: the 50% test and the 25% test.

Under the 50% test, at least 50% of the value of a fund’s total assets must consist of cash and cash items, U.S. government securities, securities of other regulated investment companies, and securities of other issuers as to which

(a) the fund has not invested more than 5% of the value of its total assets in securities of the issuer, and

(b) the fund does not hold more than 10% of the outstanding voting securities of the issuer

Under the 25% test, no more than 25% of the value of the fund’s total assets may be invested in the securities of

(1) any one issuer (other than U.S. government securities and securities of other regulated investment companies),

(2) two or more issuers that the fund controls and which are engaged in the same or similar trades or businesses, or

(3) one or more qualified publicly traded partnerships (including master limited partnerships).

As an ETP, the spot bitcoin ETFs are counted as an issuer and are also considered non-qualifying assets and therefore subject to the IRS Asset Diversification requirements for the 50% and 25% tests.

Fund Administration Assistance

The monitoring of the 90% Gross Income test and the IRS Asset Diversification requirements poses a real challenge for fund portfolio managers that are more easily handled by a fund administrator. At Ultimus, our post-trade compliance team has identified the tickers for the spot bitcoin ETFs that launched and are able to flag if a fund makes a purchase of these new ETFs. However, there is no easy way to calculate the level of non-qualifying income arising from such an investment. At Ultimus, the post trade compliance team provides reporting based on the investment as it relates to the IRS Diversification Tests.

Funds should make assessments of the level of investments in the spot bitcoin ETPs and how they can manage/mitigate the risk of failing the 90% Gross Income Test and the IRS Asset Diversification Tests.

Conclusion

If you are a portfolio manager or your firm serves as an adviser to a registered fund or ETF and are interested in investing in spot bitcoin ETFs, we recommend that you contact your fund counsel and/or your Chief Compliance Officer to discuss a possible approach to do so.

18035339 4/12/2024