Interval Funds have enjoyed a meteoric rise in recent years, and despite a challenging year, assets now top $35b as of December 31, 2020, according to Interval Fund Tracker¹. The COVID-19 pandemic fueled volatility in the wider marketplace and micro-disruptions in certain asset classes, most visibly in Real Estate, Real Assets and Credit securities.

The restricted liquidity feature of interval funds allows managers to limit the cash drag on the portfolio and manage more closely to the intended strategy. In some ways, it also protects investors from over-redeeming at what may be an inopportune time given certain market conditions. That said, an inability to exercise a full redemption request may lead to some frustration amongst fund shareholders and advisers.

Interval funds are required to offer liquidity at pre-determined monthly, quarterly, semi or annual time-periods (“intervals”), of at least 5% of fund AUM (Boards can elect to offer up to 25%). The most prominent interval funds in the market today offer stated liquidity at 5% per quarter.

²

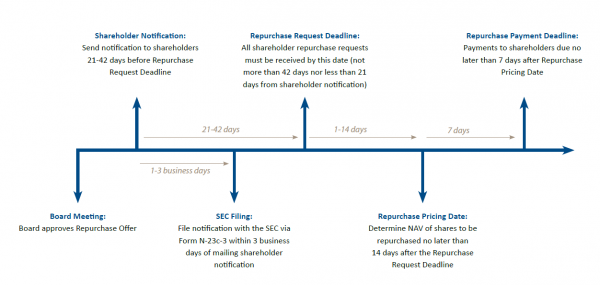

As noted in the image above, a fund will send aepurchase offer to its shareholders 21-42 days before the deadline. In that notification, the fund will specify a date by which shareholders must accept the repurchase offer, referred to above as the Repurchase Request Deadline. The repurchase pricing date usually occurs 1-14 days after said deadline. Movement with underlying investments can cause the fund price to fluctuate during that period and depending on the types of holdings in the portfolio, that fluctuation could be significant.

The severe volatility experienced in the early days of the pandemic led many investors to request redemptions through the liquidity provisions of their investment. With the volume of redemptions (too many investors / too high a percentage of the fund), many interval funds exceeded their liquidity threshold and were forced to prorate the redemptions.

Managing Proration

When fund managers encounter proration during a tender offer period, it is imperative that they communicate effectively with their investors and the advisers working with their product. Many fund managers will survey their distribution syndicate before the repurchase request deadline to understand the level and potential impact of redemptions. If proration is anticipated the fund manager can assist advisers with educating end-investors and resetting expectations on what the redemption activity will ultimately look like.

Ultimus has integrated processes within our core recordkeeping system that allow fund managers to have more visibility into the tender process and in real-time understand inflow/outflow projections. This includes real-time processing of transactions, ability to create a tender offer calendar in the system, automation of prorated redemptions and the ability to warehouse/pend trades within the system (not a spreadsheet) for a future trade date.

Fund managers should work with an experienced administrator to set up a customized procedure for their fund, to ensure they have the reporting needed during these critical operating windows for the fund. When dealing with illiquid investments and a more retail audience, communication is critical to managing adviser expectation and ultimately improving the investor experience.

For more detailed information on Ultimus’ interval and tender offer solutions, please contact us at inquiry@ultimusfundsolutions.com or here on our Contact Us page https://www.ultimusfundsolutions.com//contact/.

¹ https://intervalfundtracker.com/2021/02/01/interval-funds-2020-year-in-review/

² Source: Alston & Bird LLP