You’ve likely heard the expression: “Innovate or die” (often attributed to Peter Drucker, an influential thinker on business management). The saying holds true for investment advisers, as well. To stay relevant, firms must think about the target audiences, new product structures, new distribution methods and channels and how you can solve for the end client’s objectives.

We brought together three speakers for our recent webinar, “Product Trends: Diversifying Investors for 2021.” Dave Carson, SVP of Client Strategies at Ultimus, moderated. The panelists included Sandra Powers, Founder and CEO of ARK Global; John Hunt, Partner at Sullivan & Worcester; and Adam Kornegay, SVP of Business Development at Ultimus.

We share some of their guidance here, with tangible steps for expanding your strategy’s reach.

One Strategy. Multiple Audiences.

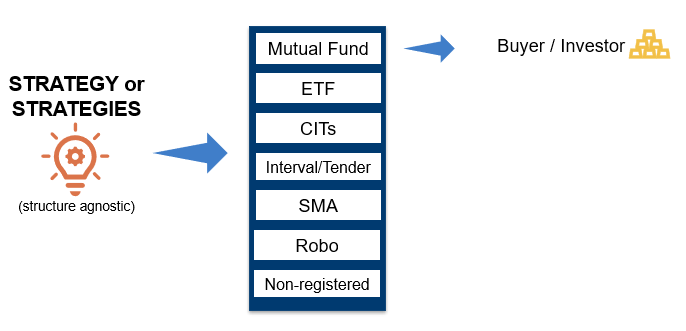

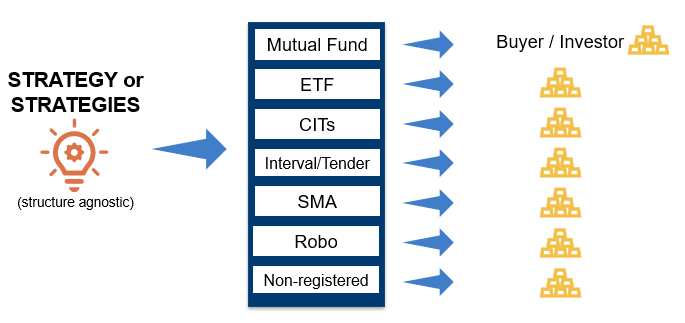

To expand an investment strategy’s reach, it is tempting to focus on product structure — perhaps adding a mutual fund to an existing lineup or launching an ETF. But before thinking about structure, our panelists recommend thinking about the prospective target audiences you want to reach and specific structural requirements for their investments working backwards from the client’s line of sight. To begin:

- Define three or four key differentiators for your strategy to clarify its appeal

- Identify and segment target audiences who would benefit from your strategy

- Identify the structural requirements and preferences of each target segment

- Prioritize the segments

OLD: One investment strategy, one structure, one target audience

NEW: One investment strategy, multiple structures for multiple target audiences

One Strategy. Multiple Audiences. Multiple Product Choices.

There is no single “right structure” for a particular strategy. Rather, the structure should be aligned with the target market’s requirements.

- Mutual Funds: As the most common retail pooled structure, mutual funds have broad distribution and allow for different share classes. The main challenge is posed by expenses associated with the regulatory framework of the Investment Company Act of 1940 (the “1940 Act”) and the increasing cost of distribution.

- ETFs: Exchange-traded funds, or ETFs, are becoming more popular, especially with the introduction of active strategies. ETFs can be cheaper for the investor and more tax-efficient than mutual funds but must also abide by the 1940 Act regulatory framework, thus increasing structural expense and as a result a higher break even point for the Sponsor.

- CITs: Collective Investment Trusts (CITs) are bank or trust company sponsored funds offered only to qualified retirement plans and exempt from registration under the 1940 Act. CITs are overseen by the Office of the Comptroller of the Currency (the “OCC”) and state banking regulators. CITs are similar to mutual funds in that they offer daily liquidity, settle via the NSCC and have very similar investment characteristics but are often lower in cost.

- Interval Funds & Tender Offer Funds: Interval funds and tender offer funds are closed-end funds registered under either the 1933 or 1940 Act. In spite of being “closed-end,” these funds do provide some liquidity provisions for investors. They can be considered a hybrid product with characteristics of both mutual funds and private funds.

- SMAs and Robo SMAs: Robo separately managed accounts (SMAs) use robotic technology create operational efficiencies and reduce the setup, management and rebalancing costs of traditional SMAs.

- Non-registered: Private, non-registered funds offer the most leeway to implement diverse investment strategies, as long as the investment strategy is properly disclosed. That freedom comes with the most restricted distribution possibilities, as investors must meet SEC-required net-worth and/or experience criteria.

In evaluating different structures, assess how efficiencies can be gained, such as running your strategies in parallel.

Example 1. An adviser manages a real estate investment strategy. Family office clients with long-term capital are comfortable with the closed-end private equity-style structure. But the adviser recognizes that younger generations have different requirements and seek exposure to this non-correlated asset class. They may seek investments with higher liquidity and this younger generation may not be accredited. The adviser creates an interval fund structure for this distinct audience. The adviser’s single strategy now has two target audiences with structures to match the requirements of each while broadening their distribution footprint.

Example 2. A long/short hedge fund manager wants to expand the strategy to non-accredited investors. The manager recognizes that a mutual fund would be an appropriate structure for the long-only portion of the strategy. The result: one strategy, two target audiences, two structures while again broadening their distribution footprint.

Example 3. A mutual fund sponsor has recently gained access to qualified retirement capital. The sponsor launches a CIT to provide its existing investment strategy to 401k and pension plans. The target audience benefits from the CIT’s lower cost and quick, simple set up.

Innovations in Marketing and Distribution.

Once target audiences are segmented and product structures are aligned with each segment, it’s time to consider messaging and determine the best avenue to reach the intended audiences. The goal: identify the best ways of selling to the right audience with the right message through the right channel.

Digital Marketing

Digital marketing has skyrocketed in the last two years, with the Covid-19 pandemic accelerating this trend. If the digital path seems the way to go, it’s important to keep a few items in mind.

- All content should flow back to the three or four differentiators of your strategy.

- Content is king. Develop a content calendar and remember that good content can be repurposed. A LinkedIn article can be turned into blog, infographic, or podcast. A video can be created to communicate investment performance and video snippets can later be used for marketing.

- Importantly, the shorter, the better. Attention spans are limited.

Investor Interface.

Investors are looking for ease of access. Direct investing accounts with a user-friendly interface and strong security have vast appeal. Plus, direct investing gives advisers the opportunity to market to the end investor, letting them invest directly without an intermediary. At Ultimus, we now support direct investing through our secure investor portal, branded with your firm’s logo and imagery, as well as through the platforms of all financial intermediaries.

Structure Trends to Watch in 2021

We asked the panelists to opine on trends they’re seeing.

- Mutual fund to ETF conversions: Vanguard’s patent permitting its mutual funds to offer an ETF share class is expiring soon. The panel will be closely watching the impact on mutual funds.

- Semi-transparent ETF structures: The panel continues to see increased interest in active, semi-transparent ETFs. Read more in our previous blog here: Non-transparent, Semi-transparent and Transparent ETFs.

- International -> US; US -> international: Although domestic and international investors have distinct needs, there are sufficient similarities and a demand for new perspectives and strategies. The panelists are seeing a trend to migrate strategies from the US to overseas and vice versa.

- Interval funds and tender offer funds: The panelists believe interval and tender offer structures will continue to gain popularity for strategies typically seen in hedge funds.

Conclusion

Ultimus provides a broad suite of fund administration and investor services for the full range of investment products and structures. As such, we see broad trends that individual advisers may be not be as familiar with and are looking for a partner to help them grow their business. We are happy to speak with advisers seeking to expand offerings to new target segments through new structures.

Our advice: Innovate. We can help guide the way.