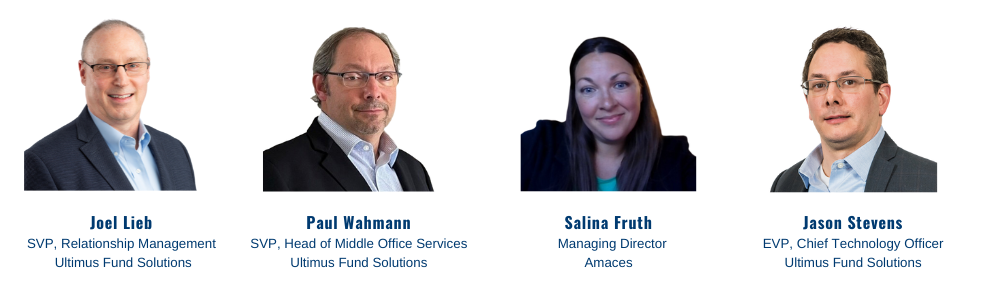

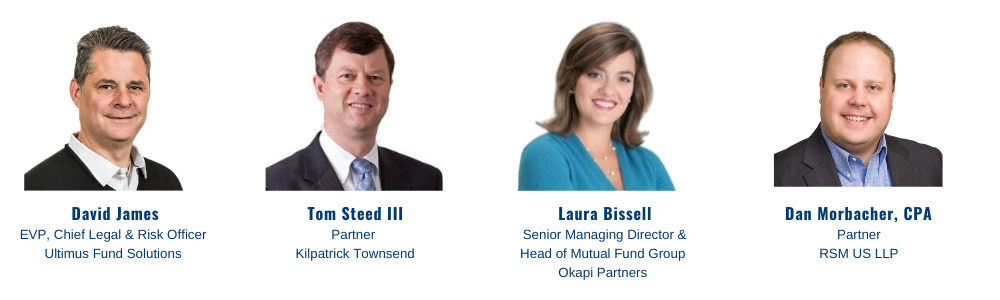

Option 1: The Current ETF Landscape: The Growth Continues

The ETF marketplace continues to expand at a record pace. In this session, industry experts will provide insights into how they are dealing with this explosive growth, covering such topics as the rise in actively managed ETFs, increased product complexities, asset conversions into ETFs, regulatory changes that could impact ETFs, and how the industry is preparing for expected future growth.

Location: Buckeye A

Option 2: Talking Scope and Requirements for Tailored Shareholder Reports (“TSR”)

On October 26, 2022, the SEC adopted a new rule that requires mutual funds and exchange-traded funds that are registered on Form N-1A to send annual and semi-annual “tailored” summary shareholder reports to all shareholders. This panel will discuss the key highlights of the rule and the challenges that face the industry.

Location: Bluegrass A

Option 3: Optimizing your Internal Operations: Middle Office

This session will provide panelist insights on headwinds facing buy-side asset manager’s operating models, including the shift to T+1 settlement, changing technologies, the need for scale and STP, and reporting.

Location: Buckeye B

Option 4: Fund Reorganizations- Everything you wanted to know

With an increasing number of mutual funds converting to ETFs, and funds combining into each other for great scale, fund reorganizations are happening more frequently. The panel is comprised of industry professionals with legal, tax and shareholder communications experience. This panel will discuss various topics associated with Fund Reorganizations such as the timing, board considerations, tax implications, various SEC filings and the proxy solicitation campaigns that are part of a reorganization.

Location: Bluegrass B