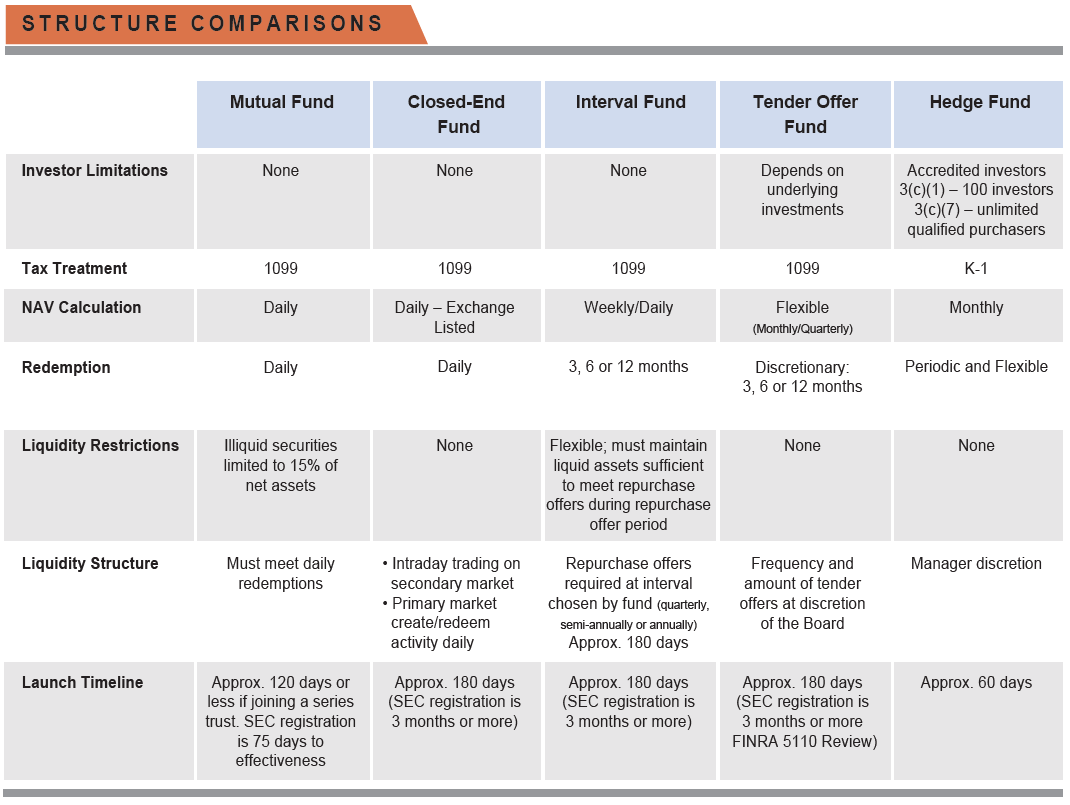

Interval and Tender Offer Funds offer retail and alternative asset managers an opportunity to differentiate their product lineup and open up new distribution opportunities by expanding access to non-correlated asset classes in a ’40 Act investment wrapper.

Both vehicles are unlisted closed-end funds that offer periodic liquidity to investors and can access through traditional mutual fund distribution channels. There has been a surge in interest from managers offering Real Estate, Credit, Private Equity, Fund of Funds and other alternative asset classes in these funds.

- SEC regulated investment structures with lower investment minimums than traditional alternative investments

- Flexibility to hold illiquid investments

- Prospectus defined shareholder liquidity

- Available through mutual fund platforms via NSCC FundServ and AIP

- 1099 tax reporting

When a manager or fund advisor considers expanding their product line by launching a interval or tender offer fund, there are questions to help determine if this is the right direction:

- Is there demand for this strategy today?

- Can offering an interval or tender offer fund create operational efficiencies? Could consolidating many accounts into one portfolio make it easier to manage?

- How frequently can the NAV calculation be supported?

- Are there resources to support product distribution efforts?

Ultimus’ experienced team of professionals are here to help you answer these questions.

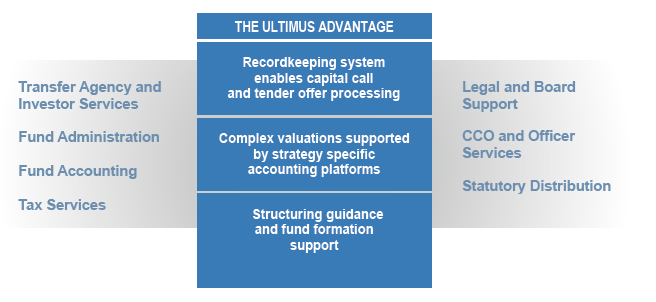

Comprehensive Fund Administration Support

To support managers in bringing retail alternatives, including interval and tender offer funds, to market, Ultimus offers a comprehensive suite of solutions.

In addition, Ultimus provides operational expertise and services necessary to support non-exchange traded closed-end fund structures. Specifically, we:

- Prepare and file registration statements

- Coordinate board meetings

- Provide periodic NAV calculations

- Reconcile cash and positions

- Conduct expense accrual analysis

- Produce quarterly financial statements

- Assist auditors with annual audit

- Assist with regulatory filings

- Provide unit-holder servicing and reporting

- Provide Chief Compliance Officer (CCO) and compliance reporting and support

Contact us to learn more or click here to read about our services for registered funds, including interval and tender offer funds.