Prior to launching a fund, investment advisers need to develop marketing and distribution strategies that take into consideration their entire business strategy. Mutual funds are a specific delivery channel for an investment strategy; in that way they can be an extension of what you already do. However, because sales and marketing for funds are likely different than what you do today, it is important to develop a complete long-term business plan for fund launch and operation. Here are a few areas to consider.

STORYTELLING TIME: MARKETING STRATEGY

A marketing strategy involves understanding how financial advisers/investors are going to learn about your mutual fund. Developing your plan should include telling your story, creating a pitchbook and designing an online presence. We have strategic business partner relationships in these areas and can point you in the right direction.

You can learn more about these mutual fund marketing tactics in an Ultimus blog post, which is included in a three-part series on launching a mutual fund.

Expert panelists shared stories and advice regarding the environment of marketing for mutual funds in our fireside chat, “Real World Marketing: Real World Stories.” Plus, industry thought leader, Bill Hortz, Dean of the Institute for Innovation Development, shared his valuable insights to help advisers create and develop their unique story.

PLAN OF ATTACK: DISTRIBUTION STRATEGY

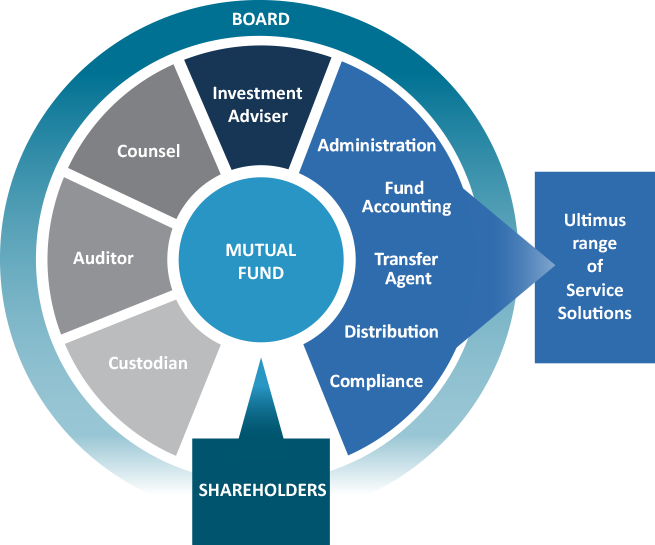

In addition to a marketing plan, a distribution strategy is essential for growing assets. Making a mutual fund available through various distribution channels to reach groups of investors requires experienced forethought and planning.

Selecting a capable firm to assist with mutual fund distribution efforts can be important. With Ultimus’ consultative and educational approach in this area, we are able to guide advisers through this challenging process. One of our insight articles, Five Critical Questions to Help Identify the Ideal Distribution Partner, highlights how investment advisers can go beyond vendor sales speak to find supportive distribution partners.

“In the mutual fund market, customization is king. Managers shouldn’t rely on an “off the shelf” program or “check box” approach. It’s imperative managers align their distribution efforts with strategic firm goals, and find a fund distribution partner who understands those goals.”

-Kevin Guerette, VP, Director of Distribution Strategies

DETERMINING AND SETTING UP A SALES STRUCTURE

In today’s distribution dynamic, there are several key considerations a mutual fund manager must think about before building their sales structure. Structure options include:

- Traditional wholesaling: model deployed by an outside sales force that spends the majority of its time on the road, meeting with prospects and clients on a regular basis.

- Hybrid wholesaling: model allowing sales team to work from an office location for a portion of their time, but also traveling in a concentrated geographic area.

- Internal wholesaling: model driven by a team typically housed on-site at the fund company.

- Virtual wholesaling: model utilizing an electronic method of sales outreach, using a firm’s website as home base for all content.

The route an investment adviser takes in building a sales structure depends on which option best suits their firm and their business goals. For a deeper dive on this topic, we examine those particular structures in this Ultimus Insight article, Wholesale Changes – Key Considerations for Launching Funds and Building a Sales Structure in the New Distribution Dynamic.

DISTRIBUTION PLATFORM PREFERENCES

Planning which platforms to engage and when is an important part of a fund’s distribution strategy. While it may seem ideal to be on as many platforms as possible, a targeted approach and long-term engagement plan, customized to the business goals, is most effective. With Ultimus’ consultative approach, we help you determine which intermediary platforms make sense based on your target audience, timing, platform cost structure and business plan. Having years of experience and connections to leverage, we will walk you through the options and provide seasoned input for your consideration.

We hope this information has been helpful and insightful. To discuss this topic further, we are happy to be a resource and will guide you through the entire process.

If you think that launching a mutual fund will be a beneficial endeavor for your business or investment strategy,