There is no doubt ETFs can have a valuable place in investor’s portfolios and as part of an asset manager’s product lineup. However, there are numerous nuances to ETFs that make them different than traditional mutual funds and a complex system of players that make an exchange-traded fund functionally efficient.

When considering launching an ETF, investment managers must understand their role in the entire ETF ecosystem. It may seem complex, but with a well-allied service provider connecting with an extensive list of established partners throughout the ETF ecosystem, fund managers can strategize and properly handle all the moving parts involved for an operationally sound and successful fund launch.

Earlier, an investment adviser may have been limited in their choice of service providers and by extension, the other key vendor relationships made available through those service providers. It is now more important than ever to work with a service provider that offers an open/flexible architecture to include other third-party vendors, with a partnership approach, a willingness to explain the process and the product, and an ability to leverage years of experience and valuable knowledge. A tech-enabled service provider that can create seamless interfaces to the key partners in the ETF ecosystem is critical to allowing advisers the freedom to build an operating model that may better adapt to innovation and unforeseen changes to the landscape.

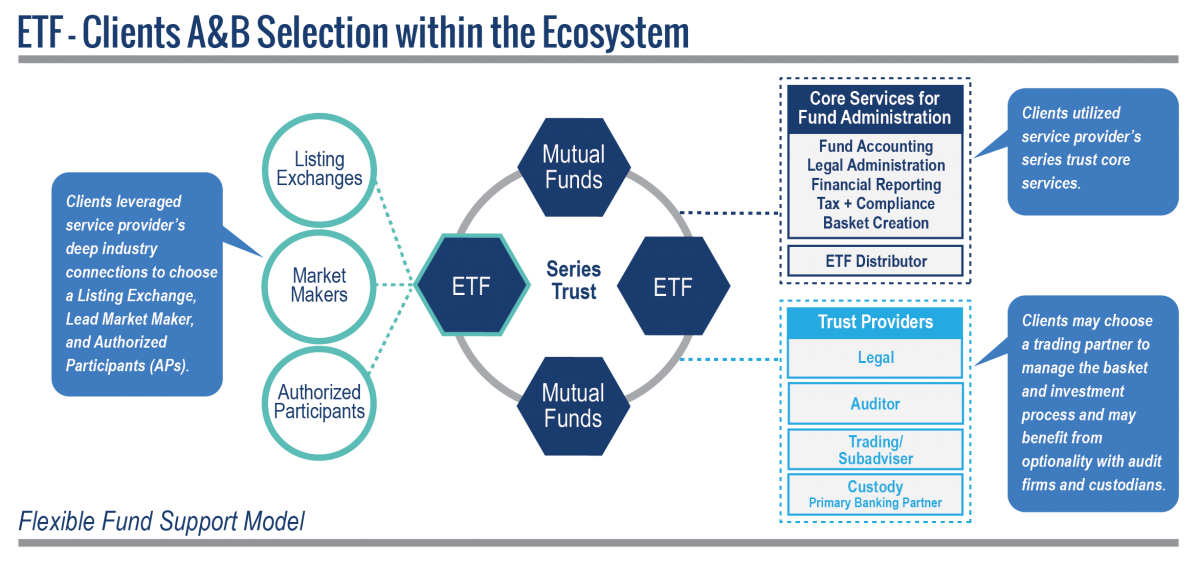

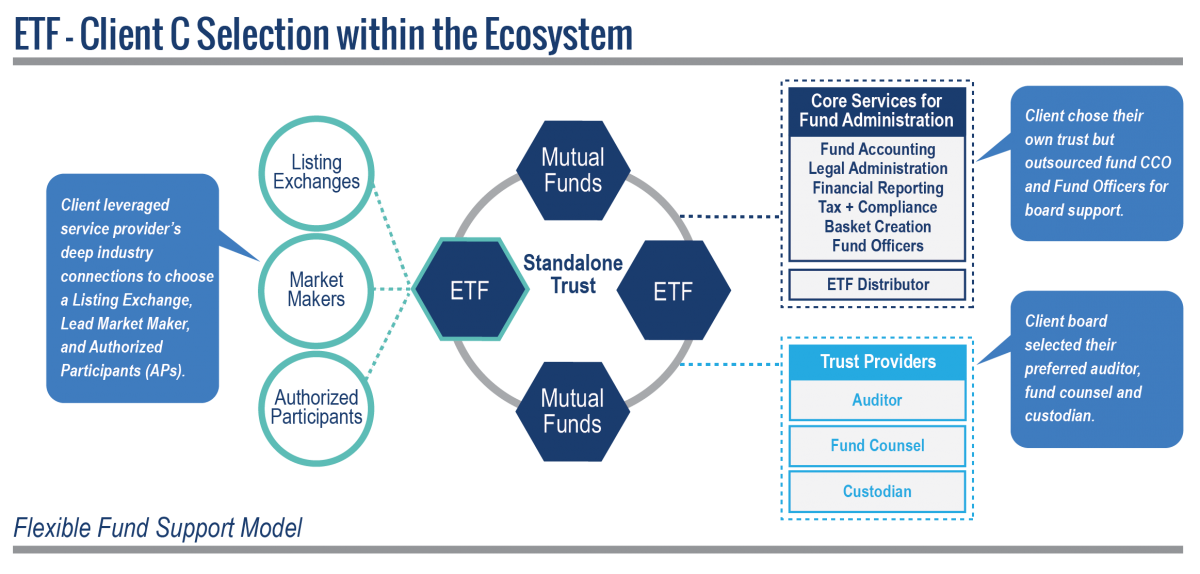

To assist with understanding the ETF ecosystem, we’ve provided three scenarios with various criteria and associated outcomes for informational purposes.

Series Trust Option

Case Study: Offering two different scenarios for Series Trusts

A multi-series trust platform enables advisers to bring new products to market in an efficient and thoughtful manner so they can focus on raising and managing assets.

Client A: A large RIA managing investment strategies in separately managed accounts. They wanted to establish a family of ETFs to create a lower cost offering for clients and enhance the tax efficiency for their investors.

Client B: An established mutual fund sponsor wanted to enter the ETF marketplace and bring the product to market in 120 days.

Both clients elected the Series Trust option for launching their ETF. A Series Trust is a turnkey governance platform that leverages an existing trust infrastructure, allowing for quicker time to market, cost-sharing amongst constituents, established provider relationships (with optionality) and providing the issuer their own branding opportunity. More information on series trust structure can be found here: Trust Options

Client C: A new entrant to the ETF marketplace wanting their own trust but required support with Fund Officers and CCO. The client needed an industry service partner that provided flexibility of services and support with hands on assistance to bring them to market.

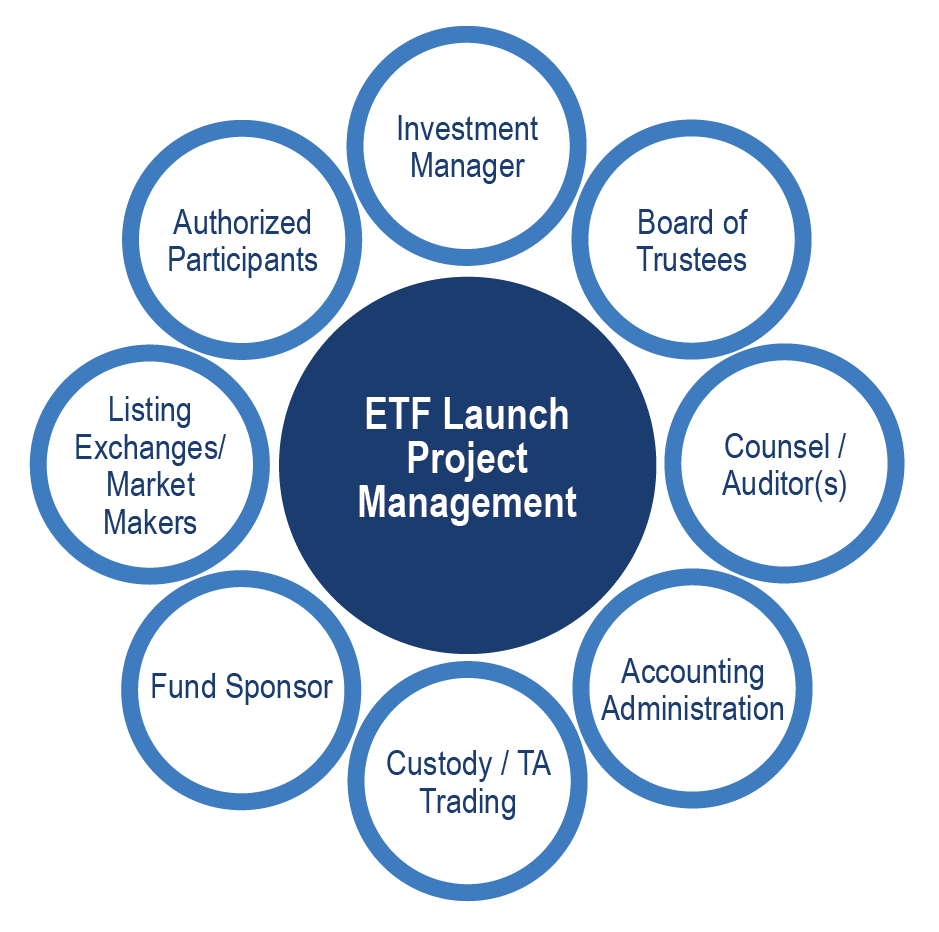

Fund Launch Project Management

Another important consideration when selecting an ETF service provider is their ability to efficiently bring you to market which includes navigating the registration process and managing project workstreams. Most fund managers are still new to managing the ETF structure and need help navigating the multi-faceted aspects of employing their strategy in an ETF format and working with a set of new stakeholders. There are no shortcuts to learning the ecosystem. It takes years of experience to understand the nuances inherent in launching a new ETF including regulatory requirements, reporting and changes.

Deep product and industry knowledge is required to properly handle all the moving parts involved in a comprehensive and operationally efficient fund launch, including proactive coordination and oversight of all parties involved.

It is important to engage a service provider that is making rapid advancements in technology by utilizing robotic processes and APIs to connect the fund manager’s fintech systems to the service providers. The right approach to utilizing technology resources enables a fund managers’ agility (i.e., the ability to choose or move to specific ETF custodians and other partners), allowing for the delivery of “best-fit” solutions and more cost-effective services.

Connecting All the Players

As you can see there are many moving parts and operational aspects to launching an ETF. Selecting the right service provider to connect with all the industry partners in the ecosystem is critical. A skilled service provider will also help fund managers strategize regarding their product structure and properly project manage the fund launch making sure the fund is best situated for a strong and operationally sound launch.

A servicer that can offer an open/flexible architecture to support the use of third-party service providers, a partnership approach, can explain the process and the product, and provides years of experience and valuable knowledge that will likely contribute to a more favorable outcome of your product.

Ultimus Fund Solutions provides a high-touch, consultative approach to help advisers with new and existing ETFs leveraging our industry knowledge, optimizing operational value to bring new products to market in a cost-effective manner. We assist investment managers in navigating the ETF ecosystem, making industry introductions to establish deep and meaningful relationships with those specialized partners that include lead market makers, authorized participants, marketing support, and trading partners. Our comprehensive ETF service offerings including fund accounting, basket services, financial, tax and legal administration, distribution and compliance and fund launch project management support.

Staying ahead of trends, Ultimus Fund Solutions was one of the first administrators to help an adviser launch a new ETF under 6c-11 disclosure requirements with its tech-enabled solutions, such as uETF. As part of Ultimus’ proprietary uSUITE® technologies, uETF provides automated workflow processing that supports basket creation, valuation, and dissemination of ETF data to required parties. uETF streamlines ETF processing operations through automating inputs, alerting users of any exceptions, producing required output files, and providing dashboards and user interfaces for full transparency into each process. This results in increased efficiency, transparency, and reduced risk.

For additional assistance with understanding the ETF ecosystem, feel free to watch this explainer video here. Ultimus supports all aspects of launching and operating ETFs and our professionals have deep industry knowledge to help you evaluate the services, service providers, and trust options critical to the success of your ETF. Contact us today for consultation about whether bringing an ETF to market is right for you and your business.