Private funds registered under the ’34 Act, also referred to as ’34 Act registered 3(c)7 funds, offer asset managers a flexible structure to expand access to alternative investment strategies for private wealth investors and deliver differentiated investment solutions to the marketplace

These ’34 Act registered private funds are limited to qualified purchasers and maintain operational flexibility by remaining exempt from the ’40 Act. By registering under the ’34 Act, these funds can welcome an unlimited number of limited partners as compared to traditional 3(c)7 funds. Growing interest in these funds has been fueled by rising demand for yield, diversification, and return sources less correlated with public markets. They offer high-net-worth and institutional investors access to private market strategies, such as private equity and infrastructure, in a semi-liquid evergreen product structure.

Benefits of ’34 Act Registered Private Funds

- Maintain operational flexibility by remaining exempt from the ’40 Act

- Provides advisers access to permanent capital and higher yields investing in illiquid private assets

- Provides private wealth investors access to alternative asset strategies

- Ability to incur higher leverage, as compared to ’40 Act funds

- Investor Transparency

- Financial information publicly available through quarterly (10-Q) and annual (10-K) reporting

- Able to charge differentiated management and performance fees by share class

- No investor cap for ’34 Act registrants, allowing an unlimited number of limited partners

- Periodic liquidity through repurchase offers

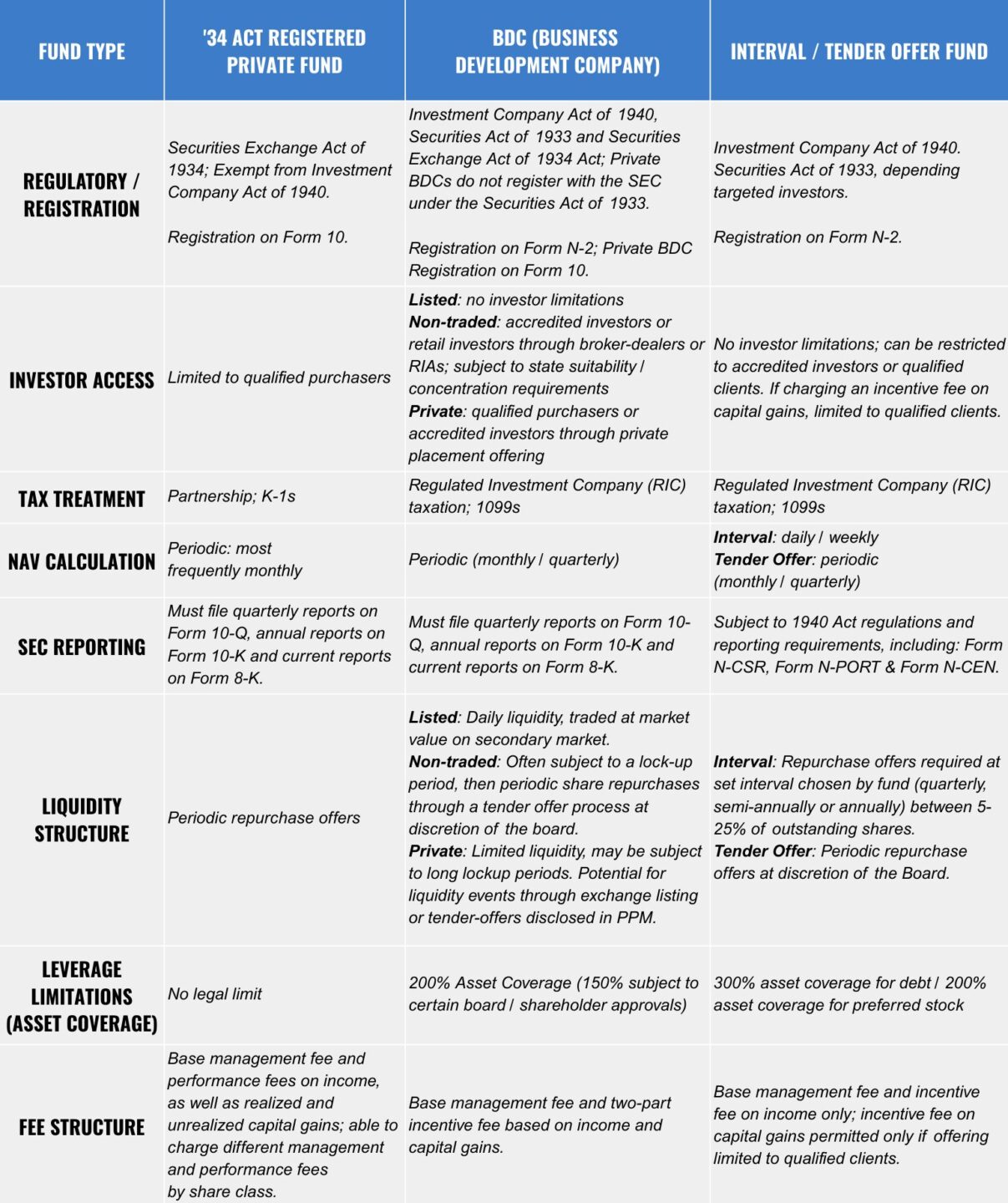

Structure Comparisons:

Understanding Where ’34 Act Private Funds Fit

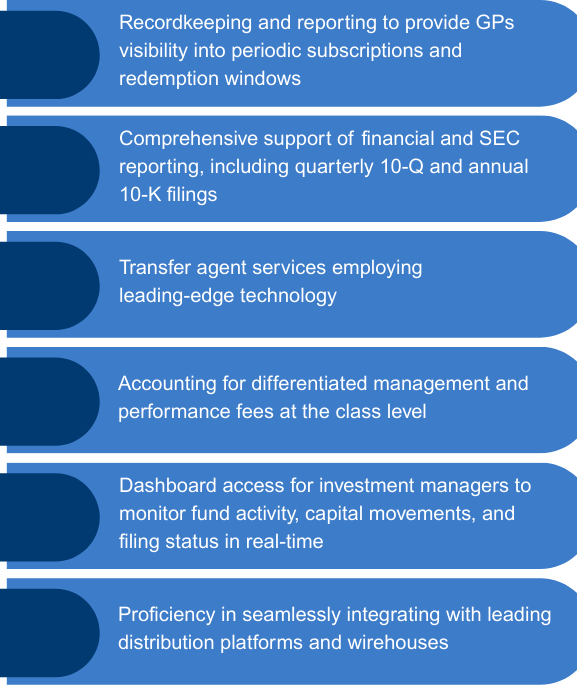

Comprehensive Fund Administration & Transfer Agency Support

To support managers in bringing retail alternatives fund structures, including ’34 Act registered private funds, to market, Ultimus offers a comprehensive suite of solutions.

In addition, Ultimus combines deep experience in both private and registered markets to deliver the comprehensive servicing framework required to support ’34 Act registered private funds.

- Provide periodic NAV calculations

- Reconcile cash and positions

- Conduct expense accrual analysis

- Prepare annual and quarterly financial statements

- Prepare and coordinate quarterly 10-Q and annual 10-K filings

- Assist auditors with annual audit and quarterly reviews

- Provide governance and filing support services to promote efficient and compliant board operations

- Schedule K-1 preparation and delivery

Ultimus recently published a blog, “Unlocking Private Markets: Why ’34 Act Registered Private Funds Are Key”, that delves into the strategic advantages and operational nuances of these structures. Click here to learn more about how these fund structures can enhance your product lineup.