Business Development Companies (BDCs) offer asset managers an opportunity to diversify their product offerings and expand distribution by providing access to private market investments, particularly private U.S. companies, within a ’40 Act investment wrapper.

BDCs are closed-end investment companies that are either listed, non-traded and sold through broker-dealer channels or private, sold through a private placement to qualified and accredited investors. Rising demand for income-oriented strategies and portfolio diversification has fueled growing interest in BDCs, as they provide investors with exposure to alternative asset classes while offering the potential for attractive yields in a regulated investment structure.

Benefits of BDCs

- SEC regulated investment structure

- Reduced burden under the 1940 Act compared to other closed-end fund structures

- Provides access to private and illiquid markets

- Investor Transparency

- Financial information publicly available through quarterly (10-Q) and annual (10-K) reporting

- Prospectus defined shareholder liquidity

- Pass-through tax treatment as a RIC

- 1099 tax reporting

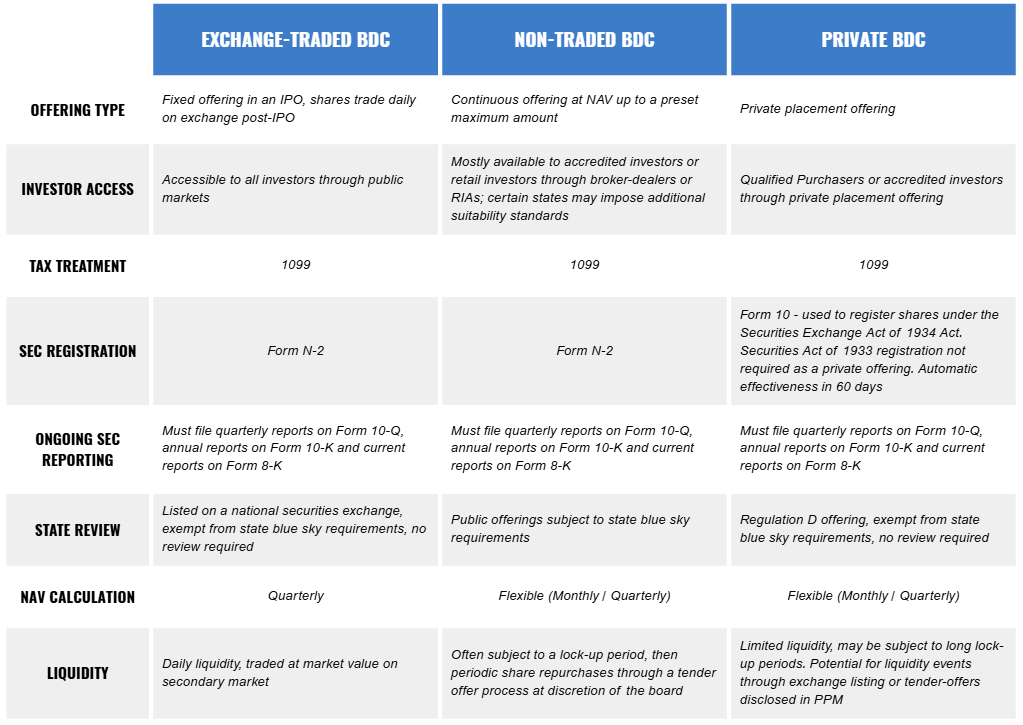

Structure Comparisons

Key Considerations

When a manager or fund advisor considers expanding their product line by launching a BDC, there are questions to help determine if this is the right direction:

- Is there sufficient investor demand or distribution capability for the new BDC product?

- Can the BDC’s investment strategy maintain at least 70% of its assets in eligible U.S. private or thinly traded public companies as required under the 1940 Act?

- What level of leverage or asset coverage requirement is most suitable for the proposed BDC, considering risk and return objectives?

- What are the potential tax implications and requirements to maintain favorable tax treatment as a regulated investment company (RIC)?

Ultimus’ experienced team of professionals are here to help you answer these questions. Contact Us

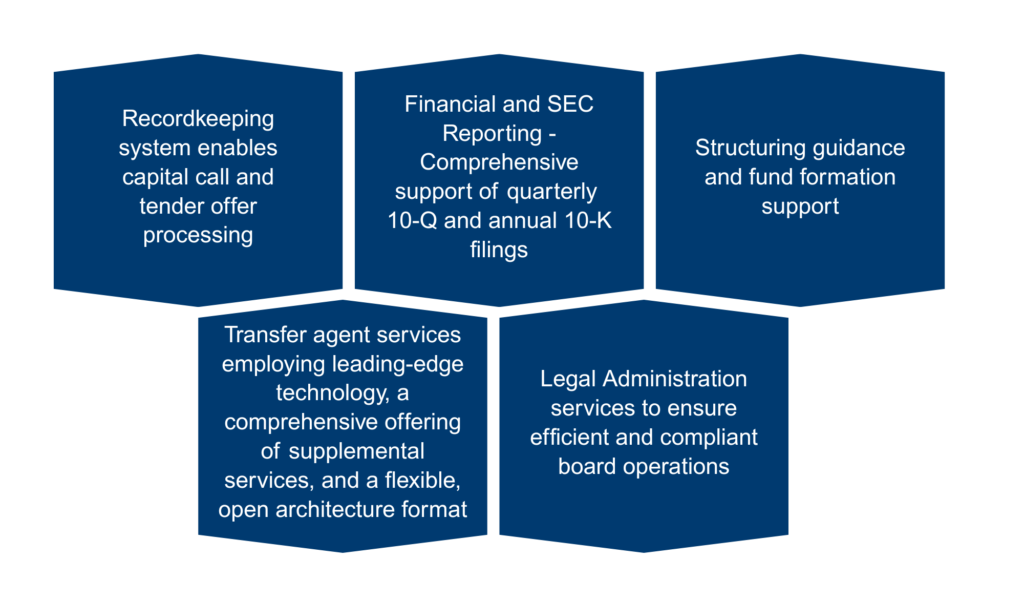

Comprehensive Fund Administration Support

To support managers in bringing retail alternatives, including BDCs, to market, Ultimus offers a comprehensive suite of solutions.

In addition, Ultimus provides operational expertise and services necessary to support listed, non-traded and private BDC fund structures. Specifically, we:

- Prepare annual calendar of board governance events

- Provide periodic NAV calculations

- Reconcile cash and positions

- Conduct expense accrual analysis

- Preparation of the annual and quarterly financial statements

- Preparation and coordination of quarterly 10-Q and annual 10-K filings

- Assist auditors with annual audit and quarterly reviews

- Prepare and file fidelity bond filings