In our recent whitepaper collaboration with XA Investments, “Launching an Interval Fund – Clear-eyed Approach to Successful Launch,” we explored various launch strategies for fund managers to efficiently bring products to market. It is becoming more and more critical that new funds reach scale quickly so that they can meet distribution platform requirements and cover elevated expenses in the interval or tender offer fund wrapper (in comparison to traditional alts or mutual funds).

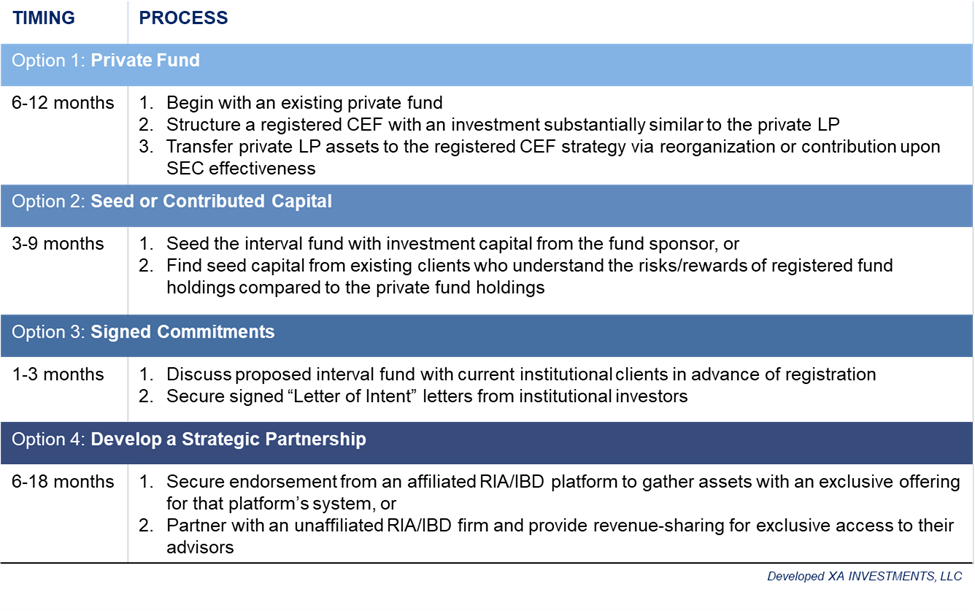

The adage ‘build it and they will come’ is certainly not applicable to launching an interval or tender offer fund. Therefore, we’ve outlined several approaches below that successful fund managers have used to launch their registered alternative strategy.

Building an effective asset raising strategy from day 1 is critical to the fund’s success. Seeding the new fund with contributed capital or converting a private fund can be a way to build momentum for external asset raising activities. As with any pooled product, certain distribution outlets will require a track record, requiring a multi-year investment from the manager to sustain operations and meet demand requirements. Hence, as the product evolves, additional distribution outlets will become available.

For more information on best practices to get through the oftentimes challenging period between fund registration and reaching $100 million in assets under management (or commercialization), otherwise known as the “valley of death,” read the white paper written in collaboration with XA Investments here.

14789897 4/6/2022