The rise in private credit and other alternative asset classes has been a major trend in recent years, driven by increasing investor demand for yield and diversification. Innovative product structures, particularly semi-liquid evergreen structures like interval funds, tender offer funds, and non-traded business development companies (BDCs), have gained popularity as vehicles that are increasing accessibility to alternative investments for retail investors. As the alternative investment product landscape continues to evolve, specialty structures such as the Securities Exchange Act of 1934 (’34 Act) registered private funds, also referred to as ‘34 Act registered 3(c)7 funds, are gaining traction in the semi-liquid evergreen product market. These funds are specifically designed for private wealth investors and are limited to qualified purchasers. Fund managers benefit from the ability to implement less liquid strategies, predominantly in private equity or infrastructure today, within a semi-liquid wrapper. Importantly, these funds remain exempt from registration under the Investment Company Act of 1940 (’40 Act), enabling them to avoid certain regulatory and reporting requirements imposed on ’40 Act registered funds.

This blog explores the key factors driving the rise of ‘34 Act registered private funds. It outlines their operational, regulatory, and structural complexities, while highlighting the importance of choosing the right administrator to help asset managers navigate this evolving segment of the alternative investment landscape.

Bridging Traditional 3(c)7 Funds and ‘34 Act Registered Private Funds

Traditional 3(c)7 funds offer several key benefits for fund managers and investors. They allow up to 1,999 qualified purchasers, specifically investors with significant wealth and financial sophistication, allowing these funds to pursue complex investment strategies with less regulatory burden. By avoiding registration under the ‘40 Act, 3(c)7 funds maintain operational flexibility, including the use of leverage and derivatives, which ‘40 Act registered funds cannot employ. These benefits make 3(c)7 funds attractive structures for private equity, hedge funds, and other alternative investment strategies targeting high-net-worth and institutional investors.

In contrast, the ‘34 Act registered private funds break from the tradition of most private funds, which typically limit their investor count to avoid public registration. By registering under the ‘34 Act, these funds can welcome an unlimited number of limited partners. However, the fund sponsor must verify that every investor meets the definition of a qualified purchaser. This generally means individuals need more than $5 million in investments, and entities must hold more than $25 million. This structure relies on the ‘40 Act’s Section 3(c)7 exemption, pairing broader access for high-net-worth investors with ongoing SEC disclosure obligations. While these funds are available to a larger pool of wealthy investors, they remain out of reach for everyday retail participants, and their offerings are structured to comply with Rule 506 of Regulation D to avoid triggering additional securities registration requirements.

Typically structured as evergreen vehicles with periodic liquidity through repurchase offers, the ‘34 Act registered private funds differ from traditional 3(c)7 funds because they are subject to ongoing reporting requirements. To register, a fund files Form 10, a detailed registration statement with audited US GAAP financial statements. This form undergoes SEC review and becomes effective automatically after 60 days.

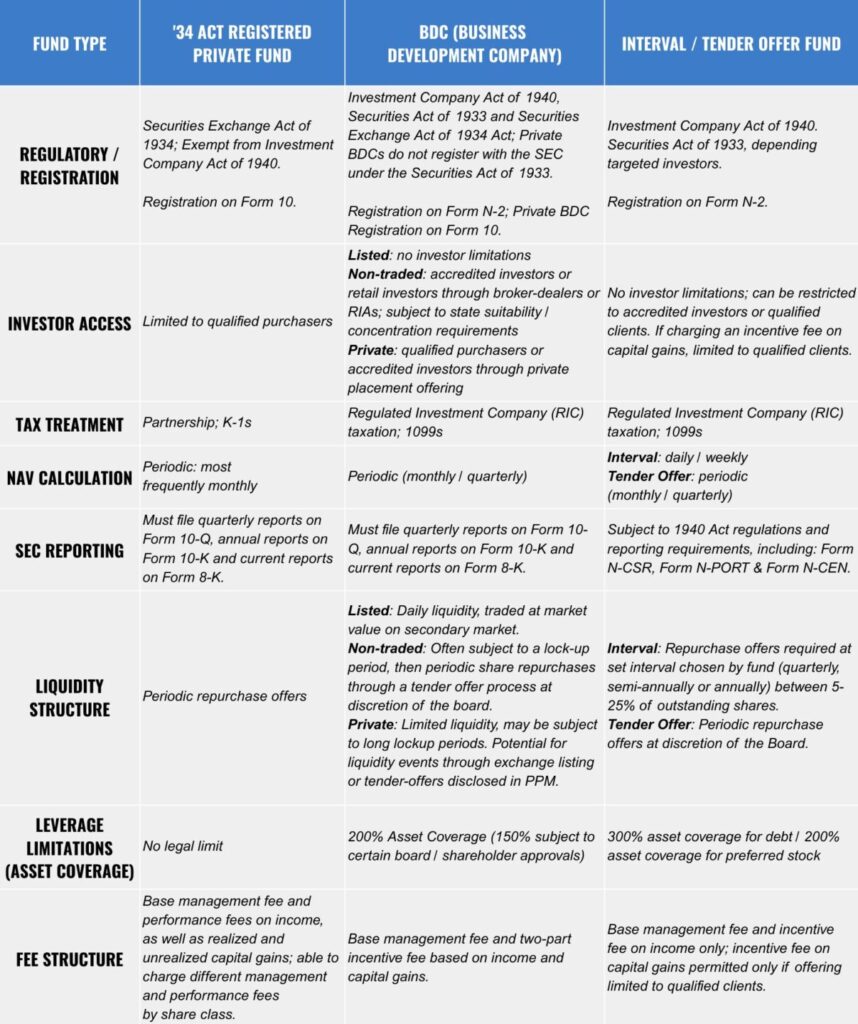

Structural Comparison:

Understanding Where ‘34 Act Private Funds Fit

At a structural level, ‘34 Act registered private funds differ significantly from other ‘40 Act registered fund types such as BDCs, interval funds, and tender offer funds. While these vehicles share some similarities, providing investors access to alternative asset strategies within a semi-liquid evergreen product, their formation, taxation, accounting treatment, and investor eligibility can vary considerably.

Tailored Solutions for Diversified Operational Needs

Administering a ‘34 Act registered private fund means supporting a hybrid fund structure that combines private fund partnership accounting with registered ‘34 Act public reporting. Unlike traditional private funds, these products must adhere to ongoing SEC filing and disclosure obligations, including annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. This requires experienced operational professionals and sophisticated systems capable of providing timely and accurate SEC reporting solutions, XBRL tagging, US GAAP financial statements, and a robust transfer agency system with integration and connectivity across custodians and distribution platforms capable of supporting high volumes of investors.

Administrators must be equipped to handle:

- SEC reporting: preparation of periodic reports, coordination with auditors, and integration with legal teams to produce accurate and timely SEC submissions.

- Enhanced recordkeeping: complete shareholder and beneficial ownership tracking, tax reporting, with timely updates to registries and transfer agency systems.

- Partnership tax and accounting: specialized accounting procedures to manage the fund’s partnership structure.

This hybrid structure, if not navigated correctly, could present operational challenges, which is why partnering with the right administrator can be critical to long-term success. At Ultimus Fund Solutions, our experience in both private and registered markets helps investment managers confidently manage complex structures like ’34 Act registered private funds.

Tax and Accounting Implications

The partnership structure for ‘34 Act registered private funds drives distinct tax treatment and accounting procedures. Unlike ‘40 Act registered closed-end fund structures taxed as a regulated investment company (RIC), these funds generally adopt a pass-through tax model. Income, deductions, gains, and losses are passed through to the partners, who receive K-1s rather than Form 1099s.

Fund administrators supporting these structures must provide aligned specialized tax and accounting services, including:

- Capital account reconciliation: Maintenance of detailed partner-level capital accounts reflecting capital activity, profits, and losses. Each investor’s capital balance must align with tax allocations and GAAP reporting.

- Management and performance fees: The ability to account for differentiated management and performance fees at the class level.

- Schedule K-1 preparation and delivery: Coordination with tax professionals to generate K-1s, capturing each partner’s share of income, deductions, and credits. Timely delivery of K-1s is critical for investor tax compliance.

Investor Servicing and Transfer Agency Functions

In the ‘34 Act environment, precision in investor accountability becomes paramount. Managing high volumes of subscription flows, transfer restrictions, and repurchase events require advanced shareholder-servicing sophistication. A capable fund administrator delivers:

- Multi-class accounting support for various share classes and distribution structures across all sales channels.

- Automated investor communications, assisting in compliance with public disclosure requirements.

- Transfer agency systems that are designed to meet higher reporting and reconciliation standards across custodians and distribution platforms.

- Real-time recordkeeping and reporting to provide GPs visibility into periodic subscription and redemption windows.

- Deep understanding of both private and registered compliance and distribution needs.

Leveraging Technology for Compliance and Efficiency

The specific data and compliance needs of the ’34 Act registered private funds can be challenging for legacy fund administration systems. A technology-forward administrator will employ cloud-native solutions and API-enabled platforms that streamline reporting and automate manual review tasks.

Key technology considerations include:

- Integrated systems: Financial and SEC reporting systems that connect general ledgers, shareholder records, and regulatory filings.

- Workflow automation: Data validation and automation to eliminate repetitive tasks and minimize filing errors.

- Real-time access: Dashboard access for investment managers to monitor fund activity, capital movements, and filing status.

- Distribution channel connectivity: Proficiency in seamlessly integrating with leading distribution platforms and wirehouses.

Governance Requirements

The Exchange Act does not mandate specific governance requirements for ‘34 Act registered private funds, such as an obligation to appoint a majority independent board or maintain an audit committee. Typically, these funds are organized as general partnerships with a board of directors that may include independent members for oversight. The board and governance structure is established according to market practice and investor expectations, rather than statutory requirements, to manage conflicts and support operational integrity.

Aligning for Long-Term Success

Bringing a ‘34 Act registered private fund to market requires a forward-looking administrative framework capable of adapting to evolving regulations and investor expectations. Whether the goal is to provide private wealth investors with access to alternative strategies through semi-liquid evergreen product structure, maintaining operational flexibility by remaining exempt from the ‘40 Act or to remove investor limitations applicable to traditional 3(c)7 funds, close alignment with an experienced administrator promotes operational readiness and confidence at every stage of the product lifecycle.

Comprehensive Fund Administration Support

To support managers in bringing retail alternative fund structures, including ‘34 Act registered private funds, to market, Ultimus offers a comprehensive suite of solutions:

- Recordkeeping system enables capital call and tender offer processing

- Comprehensive support of financial and SEC reporting, including quarterly 10-Q and annual 10-K filings

- Transfer agent services employing leading-edge technology

In addition, Ultimus provides operational skills and services necessary to support ‘34 Act registered private funds. Specifically, Ultimus can:

- Provide periodic NAV calculations

- Reconcile cash and positions

- Conduct expense accrual analysis

- Prepare annual and quarterly financial statements

- Prepare and coordinate quarterly 10-Q and annual 10-K filings

- Assist auditors with annual audit and quarterly reviews

- Provide governance and filing support services to promote efficient and compliant board operations

Conclusion

As a leading fund administrator, Ultimus combines deep experience in both private and registered markets to deliver the comprehensive servicing framework required for ‘34 Act registered private funds. Through industry-leading technology solutions, comprehensive SEC reporting support, and high-touch client engagement, Ultimus can help asset managers scale their product offerings across all retail alternative product structures, including interval and tender offer funds, BDCs, REITs and ‘34 Act registered private funds. Fund sponsors ready to navigate this sophisticated investment structure can rely on Ultimus as a trusted operational partner, empowering them to meet regulatory demands and achieve their strategic goals.

If you are ready to take the next step in this or other investment structures, contact Ultimus Fund Solutions at www.ultimusfundsolutions.com.

COD00000925 12/08/2025