Market interest has increased rapidly in the last few years regarding two types of registered closed-end funds – interval funds and tender offer funds. These structures represent a fast-growing investment vehicle that is considered by many advisers as one of the best ways of supporting client access to alternatives moving into 2020.

What is an Interval Fund?

An interval fund is a type of closed-end fund with shares that don’t trade on the secondary market. Instead, the fund offers to buy back a percentage of outstanding shares at Net Asset Value (NAV) at periodic intervals, the most common being quarterly.

Attractive Alternatives

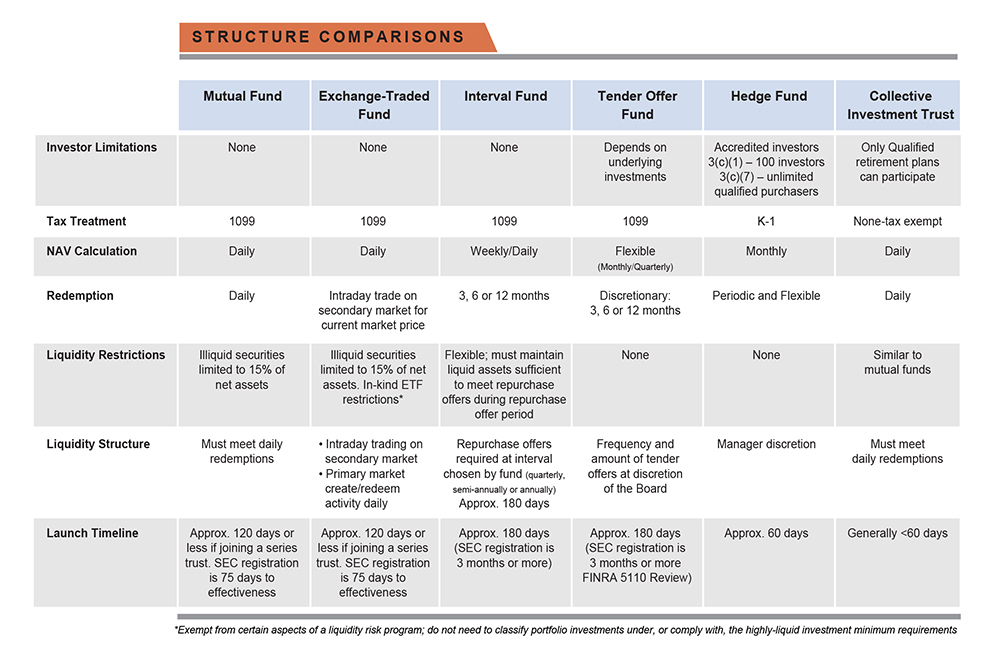

Both interval and tender offer funds are attractive compliments to open-end mutual funds, exchange-traded funds (ETFs), and traditional closed-end funds for a variety of reasons including:

- Retail and mass affluent investors can gain access to certain asset classes that have been typically unavailable to non-institutional investors.

- Interval and tender offer funds offer lower investment minimums than private funds.

- Unlike private funds, these investment products are registered with the Securities and Exchange Commission (SEC) and operate under the same governance structure as other pooled, publicly available registered investment companies.

- Strategies typically offer higher yields than most other mutual fund options, thanks largely to illiquid holdings. The ability to invest in alternative assets like commercial real estate, consumer loans, debt and other illiquids helps increase fund yields.

- Liquidity opportunities are identified in the prospectus at pre-defined periods/intervals and are fundamental fund policies that can’t be changed without shareholder approval.

- Net asset values may be published daily, monthly or quarterly, depending on strategy.

- Offers managers the ability to distribute alternative strategies through several established and diverse channels. Interval funds generally have ticker symbols and are easily researched.

- Interval Funds are tax-friendly for investors and issue Form 1099’s rather than the Schedule K-1 (Form 1065).

Are Advisers Adopting?

According to a recent InvestmentNews article, the thirst for diversification among advisers is what is leading them to the interval structure1. According to one of the advisers interviewed, the allocation to these structures ranges between 10 and 20% of client portfolios and offers a means of accessing strategies such as private real estate, private lending, specialized credit, and reinsurance policies.

According to a recent Cerulli Report2 entitled, “U.S. Alternative Investments 2019: Democratization of Alternatives”, 45% of advisers report recommending and/or using the products for clients. The report identified that asset managers should place a high-priority on investor education for advisers and end-clients so both understand the benefits, risks and investing mechanics of the structure, as well as what to expect once an allocation is made. That education and understanding, coupled with proper risk minimization and diversification strategies, can lead to broader adoption.

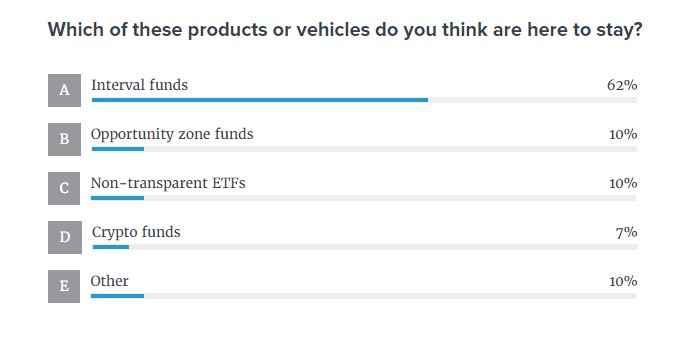

At a recent Citywire Professional Buyer Alternatives Event in San Francisco, attendees who conduct alternative investment research at a range of firms including wirehouses, family offices, and Outsourced Chief Investment Officers (OCIOs) were asked what nascent vehicle structure or fund type they thought was most likely to catch on in the near future3.

By the Numbers

The growth of interval fund products has increased over the last three years. According to the Interval Fund Tracker4 website, total interval fund net assets topped $30.8 billion in the most recent quarter, up 12% compared to 2018, this is expected to continue as the SEC declared effective three (3) new funds effective in Q3, bringing $2.2 billion in new shares to the market. There are also currently 25 additional interval funds in the pipeline pending SEC approval.

Forward-Looking Trends

Product discussions around interval funds were active in 2019, with expectations that these trends will continue into 2020. Interest is now stemming from both traditional and alternative managers, and below are a few predictions going into the new year:

- Credit, Credit, Credit – funds focused on credit lending and real estate continue to grow rapidly and adviser interest in these areas remains strong5. Most interval funds launched in 2019 have included credit strategies6. Sometimes in a low or uncertain interest rate environment, advisers are searching for alternative strategies to supplement or replace traditional fixed income investments for clients that are not paying higher yields.

- Retirement Assets/Accessing Alternatives– in June 2019, the SEC issued a “Concept Release on Harmonization of Securities Offering Exemptions”, which asked for public comment on topics related to the current framework for private securities offerings. One of the main topics discussed was expanded access to private equity, venture capital, and hedge fund strategies for retail investors7. With the shifting and/or removal of opportunities in public markets, there’s been a big push to open private investment vehicles with less liquid investments to retirement accounts. Due to the limited liquidity of the interval structure and the long-term prospects of retirement accounts, it could be a perfect match. Additionally, industry trade groups are pushing the issue with the SEC8.

- Environmental, Social and Corporate Governance (ESG) – socially-conscious investors are increasingly aligning dollars and investments with individual core values. This trend has been especially apparent with mutual fund and ETF strategies recently, and the expectation is that more interval funds will also incorporate ESG standards into their design.

- What the Crypto? – there have been a few attempts to register bitcoin interval funds, which could be a groundbreaking development for both Investment Company Act of 1940 (‘40 Act) funds and cryptocurrency9. It seems unlikely that any direct-investing crypto fund will pass through the SEC10. However, in December 2019, the SEC approved the first ever fund to achieve bitcoin returns through futures which could open the door to other creative attempts to access the cryptocurrency market11.

- ETFification of Interval Funds – the first filing for an ‘Auction Fund’12 took place earlier this year. Auction Funds are essentially tender offer funds geared to accredited investors that will leverage the NASDAQ Private Market (NPM) liquidity mechanism. The NPM is a place where investors can redeem shares with Tender Offer backstops on an exclusive secondary market – welcome to another structure option for managers13.

Value managers are not the only ones waiting for a potential market downturn in 2020. Alternative strategies providing exposure to uncorrelated asset classes and heightened yields may perform favorably to the public markets during a sustained downturn. The biggest question is whether investors using interval and tender offer funds will suddenly want to withdraw their investment.

As with any investment, investors should consider whether an interval or tender fund is appropriate for their portfolio. Although many advisers employ techniques to insulate portfolios from the risk of shareholder redemptions, such a scenario can stress a fund that holds illiquid assets. The education of advisers and investors will continue to be paramount for managers entering this space.

Ultimus is a market leader in supporting expanding access to alternative strategies to retail investors and offers a comprehensive set of interval and tender offer fund services. Company representatives can also assist with product design and operational setup. For more information, send an email to your Ultimus relationship manager or to ndarsch@ultimusfundsolutions.com.

1https://www.investmentnews.com/article/20190416/FREE/190419947/thirst-for-diversification-leads-more-advisers-to-interval-funds

2The Cerulli Report – U.S. Alternative Investments 2019 https://www.cerulli.com/about-us/press/2019-september-us-alternatives-2019/

3https://citywireusa.com/professional-buyer/news/the-categories-topping-alts-analysts-research-radar-in-2020/a1295546

4Interval Fund Tracker Quarterly Updates: https://www.intervalfundtracker.com/blog/

5https://www.barrons.com/articles/a-safer-way-to-invest-in-private-debt-1537561734

6https://www.intervalfundtracker.com/

7https://www.stradley.com/insights/publications/2019/08/fund-alert-august-2019?site=full

8https://www.sec.gov/comments/s7-08-19/s70819-6193369-192518.pdf

9Interval Fund Tracker – Get Ready for a Bitcoin Interval Fund: https://www.intervalfundtracker.com/

10https://www.sec.gov/Archives/edgar/data/1776589/999999999719005113/filename1.pdf

11 https://fundintelligence.global/compliance/news/sec-set-to-approve-stone-ridge-bitcoin-futures-interval-fund/

12 https://www.sec.gov/Archives/edgar/data/1789470/000110465919053155/a19-19405_1n2.htm

13https://www.nasdaq.com/solutions/auction-funds