As ETFs continue to grow in popularity for investors we continue to see asset managers expand their product offerings to include ETFs. However, there are numerous nuances to ETFs that make them different than traditional mutual funds, SMA accounts, or LLPs. There is a complex system of players that make an exchange traded fund functionally efficient.

When considering launching an ETF, investment managers must understand their role in the entire ETF ecosystem. It may seem complex, but with a well-allied service provider connecting with an extensive list of established partners throughout the ETF ecosystem, fund managers can strategize and properly handle all the moving parts involved for an operationally sound and successful fund launch.

In the past, an investment adviser may have been limited in their choice of service providers and by extension, the other key vendor relationships made available through those service providers. Today, with the rise of innovations like custom baskets and active ETFs, it is more important than ever to work with a service provider that offers an open/flexible architecture to include other third-party vendors, with a partnership approach, a willingness to explain the process and the product, and an ability to leverage years of experience and valuable knowledge in the ETF market. Combining that knowledge and experience with a tech-enabled service provider that can create seamless interfaces to the key partners in the ETF ecosystem is critical to allowing advisers the freedom to build an operating model that may better adapt to innovation and rapid changes to the landscape.

To assist with understanding the ETF ecosystem, we’ve provided three scenarios with various criteria and associated outcomes for informational purposes.

Series Trust Option

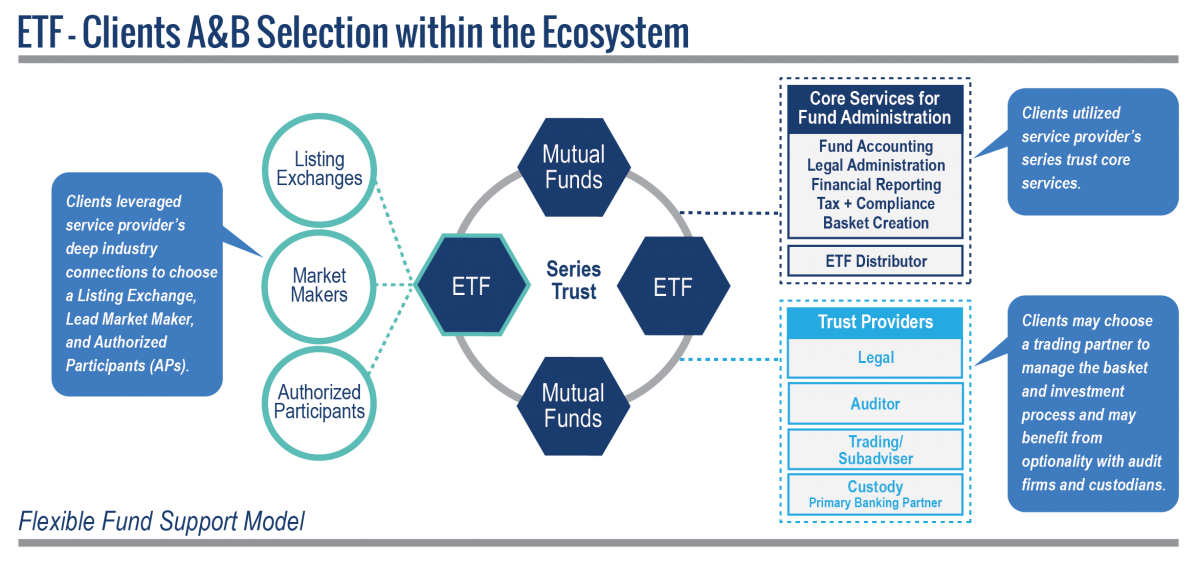

Case Study: Offering two different scenarios for Series Trusts

A multi-series trust platform enables advisers to bring new products to market in an efficient and thoughtful manner so they can focus on raising and managing assets.

Client A: A large RIA managing investment strategies in separately managed accounts. They wanted to establish a family of ETFs to create a lower cost offering for clients and enhance the tax efficiency for their investors through a 351 conversion of assets.

Client B: An established mutual fund sponsor wanted to enter the ETF marketplace and bring the product to market in 120 days.

Both clients elected the Series Trust option for launching their ETF. A Series Trust is a turnkey governance platform that leverages an existing trust infrastructure, allowing for a lower cost of entry and quicker time to market. A Series Trust also provides cost-sharing amongst constituents for on-going operations, leverage the scale of established provider relationships (with optionality) while providing the issuer their own branding opportunity. More information on series trust structure can be found here: Trust Options

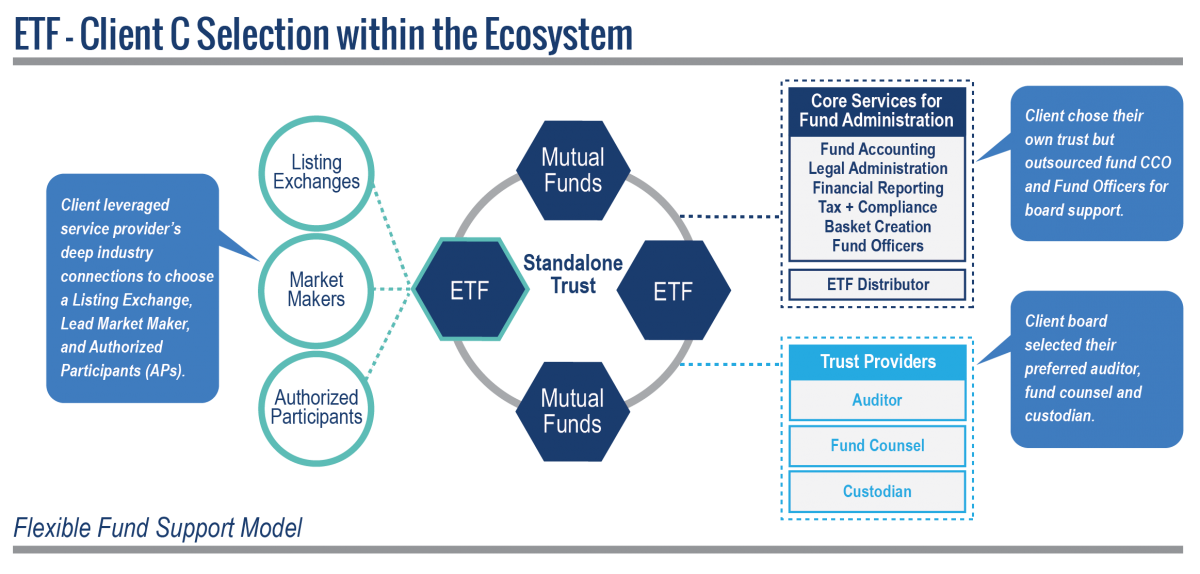

Client C: A new entrant to the ETF marketplace wanting their own trust but required support with Fund Officers and CCO. The client needed an industry service partner that provided flexibility in their services and support with hands-on assistance leading to a successful product launch.

Emerging Trends Shaping the ETF Landscape

The ETF ecosystem is not static; it is constantly evolving. Several key trends have reshaped how ETFs are structured, managed, and traded, offering new opportunities for asset managers.

The Rise of Custom Baskets

One of the most significant recent developments is the widespread adoption of custom baskets. Historically, ETFs operated with a “pro-rata” or “in-kind” basket model, where the securities delivered to or received from an authorized participant (AP) mirrored the fund’s portfolio. Custom baskets break from this rigidity, allowing the fund manager to construct a creation/redemption basket that differs from the fund’s actual holdings.

This flexibility offers several key benefits:

- Enhanced Tax Efficiency: Custom baskets can be a powerful tool for tax management. Managers can use them to strategically remove low-cost-basis securities from the fund’s portfolio during redemptions, deferring capital gains and improving the fund’s after-tax returns for investors.

- Improved Spread Management: Fund managers can use custom baskets to omit less liquid or hard-to-trade securities, making it easier and cheaper for market makers to hedge their positions. This can lead to tighter bid-ask spreads and a better trading experience for end investors.

- Operational Efficiency: In certain situations, such as rebalances or corporate actions, custom baskets allow for more efficient portfolio management by facilitating the exchange of specific securities rather than a slice of the entire portfolio.

The Growth of Active ETFs

While passive, index-tracking ETFs still dominate the market assets, active ETFs have gained significant traction. Regulatory changes, particularly Rule 6c-11 (the “ETF Rule”), have streamlined the launch process for many types of ETFs, including actively managed ones. This has encouraged more asset managers known for their active strategies in mutual funds and SMAs to enter the ETF space. Investors are increasingly embracing active ETFs for their potential to outperform benchmarks and navigate volatile markets.

Fund Launch Project Management

Advanced Technology

It is important to engage a service provider that is making rapid advancements in technology by utilizing robotic processes and APIs to connect the fund manager’s fintech systems to the service providers. The right approach to utilizing technology resources enables a fund managers’ agility (i.e., the ability to choose or move to specific ETF custodians and other partners), allowing for the delivery of “best-fit” solutions and more cost-effective services. This is especially true when managing the complexities of custom baskets and providing transparent, daily reporting required by current regulations.

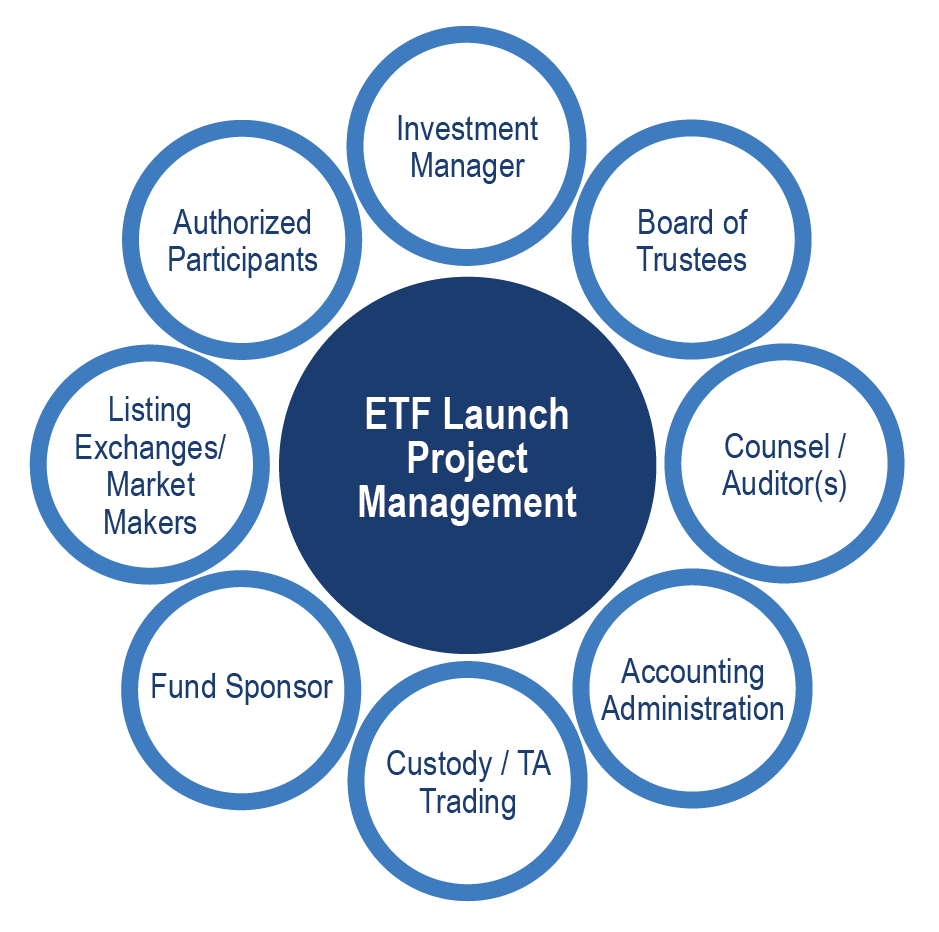

Connecting All the Players

There are many moving parts and operational aspects to launching an ETF. Selecting the right service provider to connect with all the industry partners in the ecosystem is critical. A skilled service provider will also help fund managers strategize regarding their product structure and properly project manage the fund launch making sure the fund is best situated for a strong and operationally sound launch.

A servicer that can offer an open/flexible architecture to support the use of best-in-breed third-party service providers, a partnership approach, can explain the process and the product, and provides years of experience and valuable knowledge that will likely contribute to a more favorable outcome of your product.

Navigating the ETF Ecosystem

Ultimus Fund Solutions provides a high-touch, consultative approach to help advisers with new and existing ETFs leveraging our industry knowledge, optimizing operational value to bring new products to market in a cost-effective manner. We assist investment managers in navigating the ETF ecosystem, making industry introductions to establish deep and meaningful relationships with those specialized partners that include lead market makers, authorized participants, marketing support, and trading partners. Our comprehensive and wide range ETF service offerings including full fund administration services that includes, financial, tax and legal administration, basket services, distribution, CCO compliance, fund launch project management support and comprehensive middle office services.

Tech-Enabled Solutions

Staying ahead of trends, Ultimus Fund Solutions was one of the first administrators to help an adviser launch a new ETF under 6c-11 disclosure requirements and recently launched the first money market ETF with its tech-enabled solutions, such as uETF. As part of Ultimus’ proprietary uSUITE® technologies, uETF provides automated workflow processing that supports basket creation, valuation, and dissemination of ETF data to required parties. uETF streamlines ETF processing operations through automating inputs, alerting users of any exceptions, producing required output files, and providing dashboards and user interfaces for full transparency into each process. This results in increased efficiency, transparency, and reduced risk.

For additional assistance with understanding the ETF ecosystem, feel free to watch this explainer video here. Ultimus supports all aspects of launching and operating ETFs and our professionals have deep industry knowledge to help you evaluate the services, service providers, and trust options critical to the success of your ETF. Contact us today for consultation about whether bringing an ETF to market is right for you and your business.

COD00000853 10/9/2025